Card payments are now the default for most hospitality and service-based businesses. While they make transactions faster and more convenient, they also come with processing costs that can add up quickly. Which is why many venues choose to pass on some or all of these costs through card surcharges.

Ensuring these are communicated clearly and legally ensures you’re not frustrating customers whilst avoiding obligations of this practice. In this guide, we discuss best practices for in-venue and online signage when communicating card fees.

What Are Card Fees (and Why Do Customers Notice Them)?

When a customer pays by card, the transaction isn’t free for the business. Payment providers charge a processing fee, typically made up of:

- Interchange fees (paid to the card issuer)

- Scheme fees (Visa, Mastercard, etc.)

- Acquirer or payment processor fees

A card surcharge is when a business passes this cost on to the customer rather than absorbing it into its pricing.

On-charging customers transaction fees is not uncommon, but it can cause frustration when poor communication leads them to feel they’ve copped a hidden charge. The key to avoiding negative reactions is clarity before payment, not justification after the fact.

Legal & Compliance Basics (Australia)

If you operate in Australia, the Australian Competition and Consumer Commission (ACCC) enforces card surcharge rules. The Australian Consumer Law (ACL) and the Excessive Card Payment Surcharge ban are enforced by the ACCC to protect customers from unfair or misleading pricing while still allowing businesses to recover legitimate costs of card acceptance. Below are the key compliance points every venue should understand.

Note: this article is not legal advice. For more information: https://www.accc.gov.au/consumers/pricing/card-surcharges

1. Surcharges Must Reflect Your Actual Cost of Acceptance

If you choose to surcharge, the amount you charge cannot exceed the cost you incur to process that payment type. This is called your cost of acceptance.

- Your cost of acceptance includes fees you pay to payment processors, card schemes and your acquiring bank for that specific card type.

- You cannot include unrelated business costs like wages, rent or utilities in this calculation.

- If you want to surcharge different cards at different rates, each must still be reflective of the actual cost of that card’s acceptance.

This rule stems directly from the ban on excessive card payment surcharges under ACL. A surcharge is considered excessive if it’s greater than the cost of acceptance.

2. Fees Must Be Disclosed Clearly Before Payment

By law, you must inform customers of any card surcharge before they complete the transaction.

This means clear signage in venues and transparent messaging at the point of payment or ordering, not hidden details on receipts.

If there is no way to pay without a surcharge (e.g., at a cashless venue), the surcharge must be included in the displayed price for the product or service.

3. You Must Be Able to Substantiate Your Costs

If the ACCC audits your business or receives a complaint, you need to be able to prove how you calculated your surcharge. This includes evidence such as merchant statements, contracts, or invoices from your payment provider that show your processing costs.

4. Different Card Types, Different Rules

If you accept multiple card brands or types (e.g., Visa credit, Mastercard debit, eftpos), and you decide to surcharge them differently, each surcharge amount must not exceed that card type’s cost of acceptance.

If you surcharge all card types at the same percentage, it must not exceed the lowest cost of acceptance among the cards you accept.

5. Penalties Can Apply for Non-Compliance

Charging excessive surcharges or failing to disclose them transparently can expose your business to enforcement action by the ACCC, including infringement notices or fines.

The Principles of Clear Card Fee Communication

Venues that handle card fees well focus on clarity, timing, and consistency, aligning their communication with how customers actually experience the payment process.

The most important principle is to be upfront without being apologetic.

When they’re presented confidently and matter-of-factly, customers are far more likely to accept card surcharges as part of the transaction.

Language that sounds hesitant or apologetic can unintentionally signal that the fee is unfair or negotiable. Clear, neutral wording such as “A X% surcharge applies to credit card payments” communicates the information without emotion, explanation, or friction.

Equally important is when that information is shared. Customers mentally commit to a purchase before they reach the EFTPOS terminal, so discovering a surcharge at the moment of payment can feel like a last-minute change, even if the amount is small.

To support this, effective venues use plain, direct language. The goal is immediate comprehension: what the fee is, when it applies, and how it affects the payment. This should also be consistent across all touch points, including signs at registers, online ordering pages, and on the EFTPOS terminal itself.

Where to Place Card Fee Signage

Common card fee signage placements include:

- At the venue entrance (where practical)

- On menus or ordering boards

- At the point of sale or counter

- Directly beside the EFTPOS terminal

- On online ordering and checkout pages

The best approach is to use multiple, well-timed touch points that align with how customers move through the ordering and payment process.

Ready-to-Use Card Fee Templates

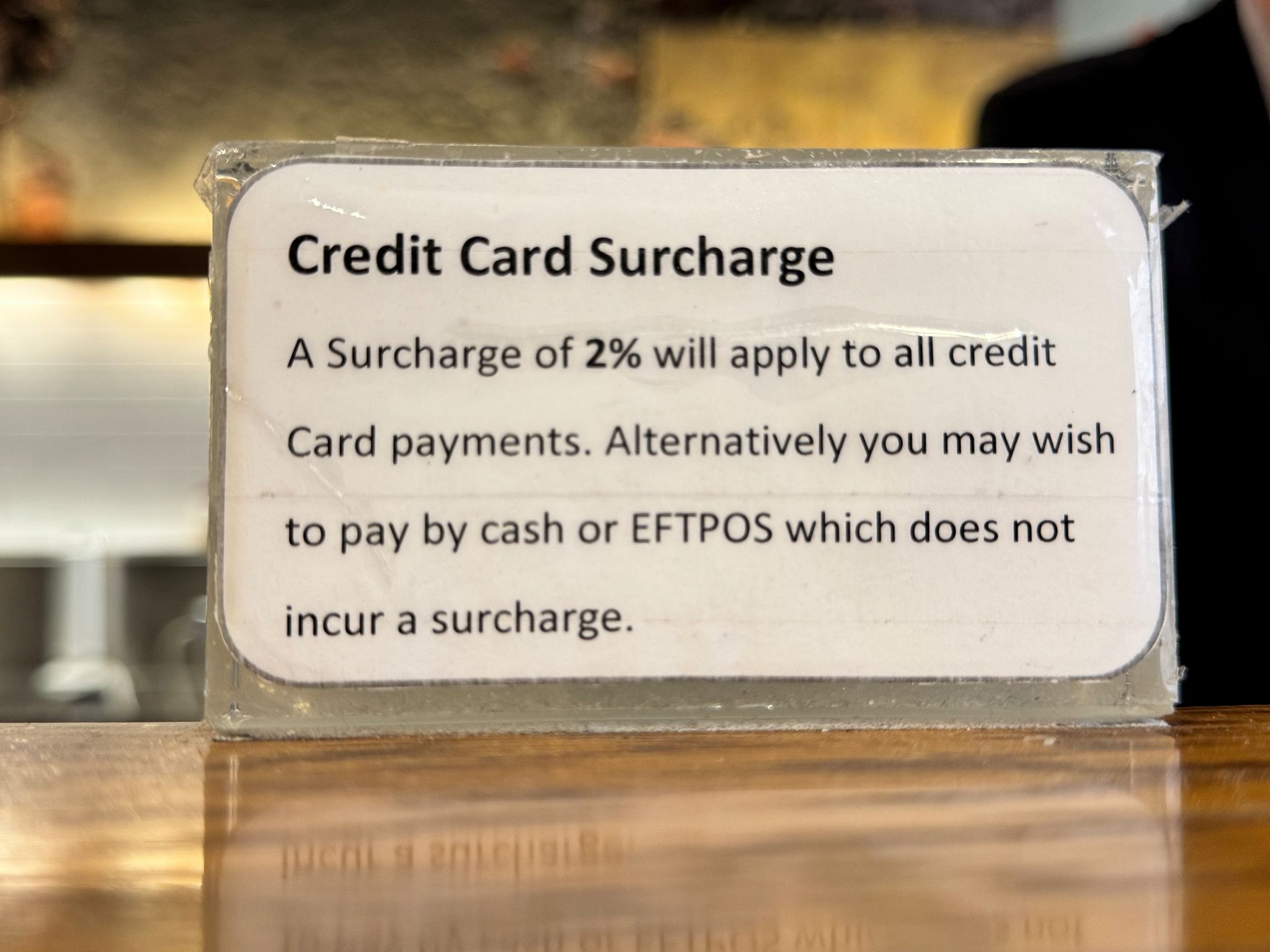

1. Short, Direct Typed Signage (Best for EFTPOS & Counter Areas)

Template A: Standard surcharge

A X% surcharge applies to all credit card payments.

No surcharge on cash or EFTPOS debit.

Template B: Card-only venue

All card payments incur a X% surcharge.

This reflects the cost of processing card transactions.

Template C: Multiple card types

Credit cards: X% surcharge

Debit cards: X% surcharge

2. Simple Graphic Signs

Template A: Non-Branded

Template B: Venue Smart Signage

At Venue Smart, we supply all of our clients with our signature signage, free of charge. This ensures our clients are following all the rules and regulations whilst looking professional and clear to customers.

Clear Communication Protects Your Business

Card surcharges are now a normal part of doing business in hospitality and service-based industries. While customers may not always love fees, they overwhelmingly accept them when they’re communicated clearly, early, and consistently.

As this guide outlines, the difference between a smooth payment experience and a frustrating one rarely comes down to the fee itself. It comes down to how and when it’s disclosed. Transparent signage, plain language, and well-placed notices ensure customers know what to expect before they pay.

At Venue Smart, we help venues implement payment solutions that are not only efficient but also transparent and customer-friendly. That’s why all Venue Smart clients receive compliant, professional card surcharge signage as part of their setup.

Book a call with one of our local representatives today to discuss our EFTPOS terminal solutions.